Understanding the California Probate Process

What is probate? It is the legal process that validates a deceased person's will and settles their estate. It means sorting out their assets, paying off debts and taxes, and giving what’s left to the rightful heirs.

When is Probate Required for Inherited Property?

In California, probate is needed if the deceased's estate is worth over $166,250. It is also required when there is real estate, no matter the value.

Steps Involved in the California Probate Process

- • Filing a petition with the probate court.

- • Notifying heirs and creditors.

- • Inventorying and appraising the estate’s assets.

- • Paying the estate's debts and taxes.

- • Distributing the remaining property.

How Long Does Probate Take in California?

It usually lasts 9 to 18 months, depending on the court's schedule and the estate's complexity.

What Happens if There Is No Will?

In such cases, California's intestate succession laws determine how the estate goes to the nearest relatives.

Inherited Property? Sell Fast & Avoid Probate Hassles! Sell Inherited Property

Avoiding Probate in California

Skipping probate speeds up property transfer to heirs and cuts costs and delays. Many Californians seek alternatives to probate to simplify the estate settlement process.

Benefits of Avoiding Probate

- • Time Savings

- • Cost Efficiency

- • Privacy

- • Simplicity

Creating a Revocable Living Trust to Bypass Probate

A revocable living trust helps a grantor skip probate. The grantor sets up the trust, puts assets in it, and manages them as the trustee following the trust's rules. When the grantor dies, the assets go straight to the chosen beneficiaries. This avoids probate and makes distribution easier.

Joint Ownership with Right of Survivorship

If one owner dies, the property automatically goes to the surviving owner(s). No probate is needed. This is common among spouses but can also apply to other partnerships.

Transfer-on-Death Deeds (TOD) for Real Estate

This tool lets homeowners choose a beneficiary. The beneficiary inherits the property right away when the owner dies. This process skips probate.

Small Estate Affidavit Process

For estates worth under $166,250, you can use a small estate affidavit. This allows for a quick property transfer without going through probate.

Legal and Financial Considerations When Selling an Inherited Home

Selling an inherited property includes many legal and financial factors. These factors can greatly affect how the sale goes and its results.

Inherited Property and Mortgage Responsibilities

If the property has a mortgage, the heir must keep paying or choose to sell it.

Inherited Property Tax Implications

Understanding property tax reassessments under Prop 19 is important. Inheriting property can raise tax obligations significantly.

Title and Ownership Verification Before Selling

Ensure the title is clear, with no liens or disputes, and that you have the legal right to sell.

Required Documents for the Sale

- • Death Certificate

- • Proof of Executorship

- • Deed and Property Documents

- • Tax Records and Compliance Certificates

Worried About Probate or Tax Issues? Get a free cash offer today! Avoid Probate Hassles

Capital Gains Tax on Inherited Property

What is the Step-Up in Basis Rule? This rule changes the property's tax basis to its market value when inherited. This can lower capital gains taxes if the property is sold later.

How Capital Gains Tax on Inherited Property Is Calculated

Take the sale price and subtract the property's tax basis. The tax basis is the market value when the original owner passed away. If the property sells for more than the stepped-up basis, the difference is the capital gain. This gain is subject to taxation. If a property cost $300,000 and was worth $500,000 when the owner died, then sold for $550,000, the taxable gain is $50,000.

Strategies to Reduce or Avoid Capital Gains Tax

Consider holding it for at least a year to qualify for lower long-term capital gains rates. You can also live in the property as your main home for two of the last five years. This may help you exclude up to $250,000 of capital gains if you're single. If you're married and file jointly, you could exclude up to $500,000. Also, you can offset your gains with losses from other investments. This can help balance your taxable income.

Exemptions and exclusions

Other exemptions might apply based on local laws and your situation, plus the home sale exclusion. For example, if the sale involves a decedent's estate, state rules could reduce the taxable amount.

How to Sell an Inherited House Fast in California

Sell your house right after probate closes. This way, you can take advantage of good market conditions. To get ready for the sale, clean the house. Then, remove personal items and fix any repairs. This will boost its appeal and value.

Selling As-Is vs. Making Repairs

- • As-is: Selling a property "as-is" means you sell it just as it is now. This can speed up the sale, but it might bring in lower offers.

- • Making Repairs: Making important repairs can boost the property's market value. This attracts more buyers and can lead to better offers.

Working with Real Estate Agents vs. Selling FSBO (For Sale By Owner)

- • Real Estate Agents: Agents have skills in marketing, negotiation, and local market trends. This expertise helps you get a better deal and sell faster.

- • FSBO: Selling on your own can save you money on commissions. But it takes more effort. You’ll need to handle marketing, negotiation, and legal issues.

Flat Fee MLS California: Listing on the MLS to Attract More Buyers

Pay a flat fee to list your inherited property on the MLS. This gets it in front of many buyers and realtors. This method uses a realtor network's reach and FSBO savings. This can result in faster sales and better offers.

Selling to Cash Home Buyers

John Buys Bay Area Houses provides a quick and easy way to sell inherited properties. You won't have to make repairs or wait long on the market.

Confused About Inherited Property Taxes?

Sell your inherited property fast and save on capital gains tax. Learn More About Tax Savings

Multiple Heirs Selling an Inherited Property

When multiple heirs inherit a property, selling it can get tricky. This is especially true if they disagree on the next steps. Here are effective ways to handle these situations:

How to handle disagreements among heirs: Open communication and negotiation are key. Consider mediation if disputes arise.

Legal options when one heir wants to sell, but others don’t: A partition action may be necessary if the heirs cannot agree on what to do with the property.

Partition actions and court intervention: This process divides the property or its sale money among the heirs.

California Real Estate Disclosure Laws for Inherited Property

California requires specific disclosures for real estate, including inherited properties. It’s important to know these laws if you’re selling an inherited property in the state.

What Sellers Must Disclose to Buyers

- • Material Facts

- • Environmental Risks

- • Death on the Property (within the past three years)

- • Neighborhood Nuisances

Required Seller Disclosure Forms

- Transfer Disclosure Statement (TDS)

- Natural Hazard Disclosure Statement

- Preliminary Title Report

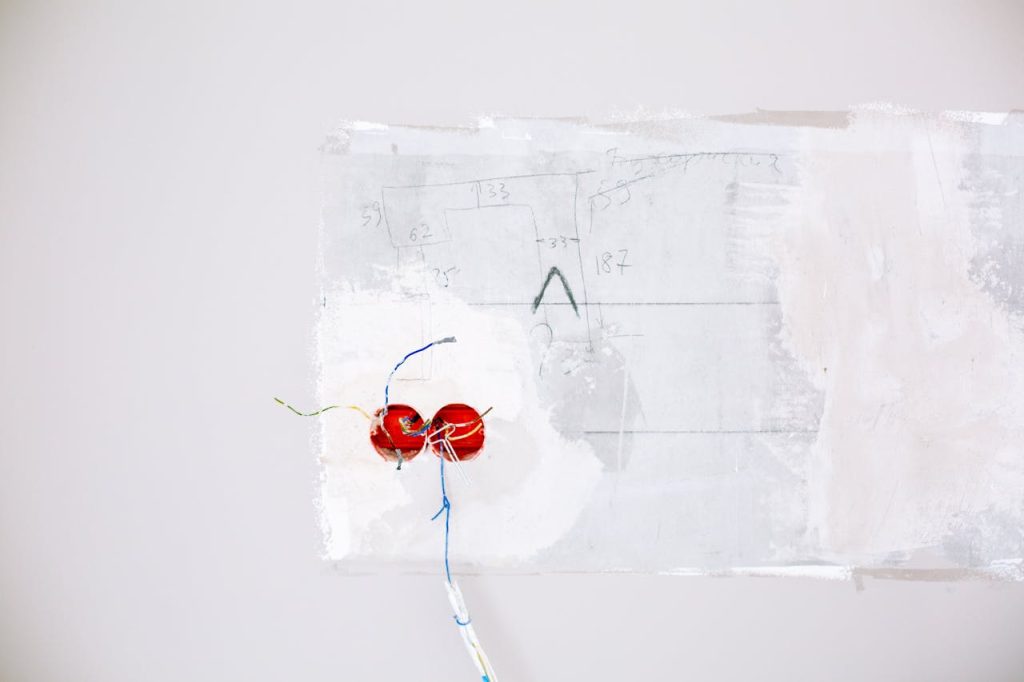

Common Issues in Older Inherited Homes That Must Be Disclosed

- • Old plumbing and electrical systems.

- • Foundation and structural problems.

- • Roof condition

- • Pest infestations

Inherited a Property?

Sell it fast and hassle-free with no capital gains tax worries. Sell Inherited Property!

Taxes and Fees Associated with Selling an Inherited Property

Property Tax Implications After Inheritance: In California, when you inherit a property, it usually gets reassessed at market value. This can raise property taxes. If certain conditions are met, exemptions like the parent-child exclusion can help. You need to file a change in ownership form. This could lead to a reassessment. However, exclusions may help reduce tax impacts.

Transfer Tax Rates in California

The transfer tax on property sales includes local taxes. These taxes depend on the sale price and are usually paid by the seller. There is also a state documentary transfer tax. It is $0.55 for every $500 of the property's value.

Federal Estate Tax and Exemptions

The federal estate tax affects estates that go over a limit. In 2025, this limit is about $12.92 million for individuals. It may change slightly due to inflation. Estates worth less than this amount usually don't owe federal estate tax. However, estates valued above it may face high tax rates.

Other Costs to Consider

- • Legal Fees

- • Title Transfer Fees

- • Realtor Commissions

Final Steps: Closing the Sale and Transferring Ownership

To sell an inherited property in California, follow these key steps for a legal and smooth sale.

- • Review Before Accepting Offers: Check offers carefully to ensure they meet your needs and expectations.

- • Escrow Process in California: Understand the escrow process. It begins with the initial agreement and ends with the final ownership transfer.

- • Handle the Proceeds from the Sale: Consider the financial impact of the sale. Think about any taxes you owe. Also, decide how to share the funds among the heirs.

No Repairs Needed – We Buy Houses As-Is! Get a No-Obligation Offer

Conclusion: Seamless Solutions for Selling Inherited Properties

Given the right knowledge, selling an inherited property in California can be simple. If you have probate or tax issues, or if you plan to sell, John Buys Bay Area Houses can help. They offer a simple and trustworthy solution for homeowners. Embrace a straightforward selling experience that respects both your time and emotional journey.

FAQs about How to Sell an Inherited Property in California Fast

How can I dodge capital gains tax on a property I inherited in California?

Use the step-up in basis and think about keeping the property. This will help you qualify for the primary residence exclusion.

What is the timeframe for selling a house in California after probate is completed?

You don’t have to wait after probate to sell an inherited house in California.

Do all heirs have to agree to sell an inherited property in California?

Not necessarily. However, all parties involved must be addressed through an agreement or court intervention.

What happens if an inherited house has a mortgage?

The heir must either continue paying the mortgage or arrange to pay it off through the sale proceeds.

Can I sell an inherited property without going through probate in California?

Yes, if the estate qualifies for small estate procedures, or if the property is held in a trust or joint tenancy.